MMlive - Ứng dụng giải trí hàng đầu Việt Nam

Một trong những ứng dụng livestream HOT nhất hiện nay không thể bỏ qua đó MMLive. Đến với ứng dụng, anh em được thỏa mãn xem gái xinh, được trò truyện và cược trực tuyến với nhiều trò chơi quen thuộc dễ kiếm tiền. Cùng tham khảo qua bài viết nói về ứng dụng livestream này nhé.

Các nhà cái top 1 hiện nay

Tổng quan về ứng dụng MMLive

MMLive là một trong những nền tảng livestream nổi bật nhất hiện nay, thu hút lượng lớn người dùng trên toàn thế giới và không ngừng phát triển. Mục tiêu mang đến giây phút giải trí tuyệt website đã nhanh chóng chiếm lĩnh thị trường trở thành điểm đến yêu thích của rất nhiều tín đồ.

Phát triển mạnh mẽ trong suốt những năm qua, nền tảng chuyên cung cấp các chương trình livestream độc đáo với sự tham gia của hàng nghìn idol, hotgirl, streamer quyến rũ, sexy. Các cô gái xinh đẹp, thân hình nóng bỏng thu hút ánh nhìn luôn sẵn sàng trò chuyện, giao lưu mang đến phút giây thư giãn cho người xem. Mỗi buổi livestream đều là cơ hội để bạn gặp gỡ tham gia cuộc trò chuyện vui vẻ thú vị.

Tính năng nổi bật của nền tảng thu hút hội viên

MMLive xây dựng không gian giải trí, kết nối đặc biệt với những tính năng nổi bật thu hút anh em như:

Theo dõi livestream idol

Trải nghiệm MMLive, bạn sẽ được tham gia xem livestream trực tiếp, nơi các idol xinh đẹp quyến rũ chia sẻ khoảnh khắc thú vị trong cuộc sống hàng ngày. Những buổi phát sóng này hấp dẫn anh em bởi câu chuyện vui nhộn, cảm nhận sự gần gũi và năng lượng tươi mới từ các cô gái nổi bật.

Tương tác trực tiếp cùng idol

Khi tham gia MMLive, bạn được trò chuyện trực tiếp với những idol yêu thích. Không còn là người xem thụ động, giờ đây anh em có thể trò chuyện, đặt câu hỏi chia sẻ cảm xúc của mình.

Các cuộc trò chuyện này mang đến sự gần gũi tạo ra không gian tương tác sống động, nơi bạn chia sẻ kết nối với những người cùng sở thích. Mỗi lần giao lưu, hội viên sẽ cảm thấy mình như một phần trong cộng đồng, nơi mọi người luôn sẵn sàng trò chuyện tương tác thân thiện.

Tham gia trò chơi hấp dẫn

MMLive cung cấp hàng loạt trò chơi giải trí đa dạng, từ những game nhẹ nhàng giúp thư giãn cho đến siêu phẩm cá cược trực tuyến đầy kịch tính. Bet thủ có thể tham gia để xả stress thử vận may. Bên cạnh đó, nhiều phần thưởng hấp dẫn luôn chờ đón những tay chơi may mắn, tạo thêm động lực, niềm vui cho mỗi lần tham gia.

Ngắm gái xinh mọi thời điểm

Với MMLive, bạn có thể thưởng thức vẻ đẹp của các cô gái xinh đẹp mọi lúc, mọi nơi. Idol với thân hình nóng bỏng, xinh đẹp luôn xuất hiện trong những buổi livestream, thu hút ánh nhìn người xem.

Dù anh em đang ở đâu, chỉ cần một thiết bị kết nối internet sẽ có thể tham gia vào các buổi phát sóng trực tuyến để chiêm ngưỡng trò chuyện cùng idol xinh đẹp, quyến rũ. Nền tảng mang đến không gian giải trí hoàn hảo, nơi hội viên thỏa sức tận hưởng phút giây thư giãn tuyệt vời.

Đối tượng người dùng MMLive hướng đến

MMLive là nền tảng giải trí trực tuyến đa dạng, phục vụ nhiều nhóm đối tượng với các sở thích, nhu cầu khác nhau như:

- Thiên đường cho tín đồ đam mê theo dõi các hot girl, streamer nổi tiếng theo dõi các buổi livestream hấp dẫn. Nếu bạn thích giao lưu trực tiếp, những buổi trò chuyện thú vị ngắm nhìn idol quyến rũ nền tảng chính là điểm đến lý tưởng.

- Bet thủ có thể khám phá nhiều tựa game đa dạng, tham gia vào cộng đồng sôi động kết nối chia sẻ đam mê cùng những người chơi khác.

- Nền tảng mang đến không gian giao lưu cởi mở, nơi người dùng có thể trò chuyện, kết nối tìm kiếm những mối quan hệ mới, gặp gỡ bạn có cùng sở thích.

Các sảnh đặc biệt website đang cung cấp

MMLive mang đến cho người dùng những sảnh đặc biệt phục vụ t nhu cầu giải trí khác nhau gồm:

Sảnh theo dõi

Sảnh theo dõi là nơi anh em có thể tìm thấy tất cả các idol mà mình yêu thích và đã theo dõi trên MMLive. Khi idol mà bạn theo dõi bắt đầu livestream, sẽ xuất hiện ngay lập tức trong chuyên mục này. Như vậy hội viên sẽ dễ dàng theo dõi, không bỏ lỡ bất kỳ buổi phát sóng nào. Cách nhanh nhất giúp bạn luôn giữ kết nối với các idol yêu thích, đồng thời không phải mất thời gian tìm kiếm mỗi khi họ lên sóng.

Sảnh nổi bật MMlive

Nơi đây tổng hợp những phòng livestream có lượng người xem đông nhất ở thời điểm hiện tại. Mục tiêu mang đến cho hội viên trải nghiệm sôi động, hấp dẫn, sảnh này luôn cập nhật hot girl đang thu hút sự chú ý của cộng đồng.

Khi truy cập bạn sẽ dễ dàng tìm thấy những idol hot nhất tham gia vào các buổi livestream đang cực kỳ sôi động. Cơ hội để thành viên thư giãn giao lưu với đông đảo người xem khác.

Sảnh game

Dành cho cược thủ, sảnh game của MMLive cung cấp những trò chơi trực tuyến thú vị, vừa giải trí lại có thể kiếm tiền. Nơi lý tưởng để bạn thỏa mãn đam mê, thử sức với các trò chơi đầy thử thách, tận hưởng phần thưởng hấp dẫn. Mỗi ván cược mở ra cơ hội kiếm tiền khủng cho bet thủ mang về khoản lợi nhuận khủng.

Sảnh xinh đẹp

Sảnh xinh đẹp của MMLive là thiên đường dành cho anh em thích vẻ đẹp và tài năng của các cô nàng xinh xắn. Tại đây, thành viên sẽ được chiêm ngưỡng những idol có vẻ ngoài tuyệt sắc, sở hữu tài năng ca hát, nhảy múa, giao lưu với người xem nhiệt tình. Cuộc trò chuyện gần gũi, màn trình diễn ấn tượng chắc chắn sẽ làm bạn không thể rời mắt khỏi màn hình.

Sảnh gợi cảm

Sảnh gợi cảm MMLive là không gian đặc biệt dành cho hội viên muốn thưởng thức sự quyến rũ, nóng bỏng của các cô nàng 18+. Tại đây, anh em được chiêm ngưỡng idol sở hữu vẻ đẹp quyến rũ, thân hình nóng bỏng và những buổi livestream đầy lôi cuốn. Nơi lý tưởng để thư giãn giải trí sau giờ làm việc căng thẳng.

Sảnh PK

Sảnh PK MMLive là nơi của những idol đang tham gia vào các cuộc thi đấu đối kháng với nhau. Người dùng có thể lựa chọn hotgirl mình yêu thích, tặng quà để giúp họ chiến thắng.

Một không gian đầy kịch tính, cạnh tranh, nơi bạn có thể tham gia vào các hoạt động tặng quà, hỗ trợ idol mình yêu thích. Sảnh PK mang lại không khí sôi động cho anh em thư giãn trải nghiệm sự phấn khích của cuộc thi.

Đăng ký tài khoản trên nền tảng nhanh chóng

Để tận hưởng đầy đủ dịch vụ tại MMLive, bạn cần hoàn tất quá trình đăng ký tài khoản, cụ thể các bước thực hiện như sau:

- Bước 1: Anh em truy cập vào trang web chính thức của nền tảng qua liên kết cập nhật mới nhất, hãy đảm bảo đúng địa chỉ để tránh những trang giả mạo.

- Bước 2: Trên giao diện chính của website, tìm và nhấn vào nút đăng ký ở góc trên bên phải màn hình.

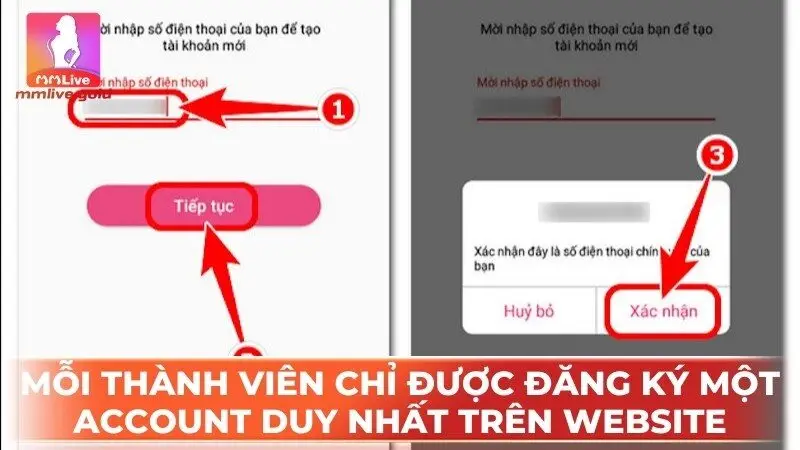

- Bước 3: Điền đầy đủ các thông tin cá nhân cần thiết như họ tên, email, số điện thoại, tên tài khoản, mật khẩu sau đó kiểm tra kỹ lưỡng trước khi tiếp tục để tránh gặp sự cố.

- Bước 4: Sau khi đăng ký thành công, hệ thống sẽ gửi email xác nhận để kích hoạt tài khoản thành công.

Cài đặt ứng dụng trên di động dễ dàng trải nghiệm

Để trải nghiệm những tính năng MMLive cung cấp một cách tiện lợi hơn, anh em có thể cài đặt ứng dụng về di động cá nhân, cụ thể các bước thực hiện diễn ra như sau:

- Bước 1: Đầu tiên bạn hãy sử dụng đường link chính thức nền tảng cung cấp để truy cập vào trang chủ hệ thống một cách an toàn.

- Bước 2: Tiếp đến trên trang chủ vào mục tải app, chọn đúng liên kết dành riêng cho hệ điều hành đang sử dụng để cài đặt.

- Bước 3: Quá trình download và cài đặt sẽ diễn ra tự động tuy nhiên người dùng cần cấp quyền cho ứng dụng không rõ nguồn.

- Bước 4: Sau khi hoàn tất, trên màn hình chính của di động hiển thị app cả nền tảng, lúc này có thể truy cập để khám phá dịch vụ ngay.

Câu hỏi thường gặp

Nhằm giúp anh em hiểu rõ hơn về nền tảng, dưới đây là một số câu hỏi thường gặp đã được giải đáp chi tiết:

Ai có thể đăng ký sử dụng dịch vụ MMLive cung cấp?

MMLive luôn chào đón tất cả người dùng có đam mê giải trí, giao lưu. Tuy nhiên, để bắt đầu trải nghiệm, bạn cần đáp ứng một số yêu cầu cơ bản nền tảng đưa ra. Hội viên phải đủ 18 tuổi trở lên đồng thời khi đăng ký cần đồng ý với các điều khoản, điều kiện website đưa ra. Như vậy giúp đảm bảo mọi người tham gia vào một cộng đồng an toàn, hợp pháp mang lại trải nghiệm tốt nhất cho tất cả anh em.

Người dùng được sử dụng tối đa bao nhiêu tài khoản?

MMLive rất nghiêm ngặt trong việc quản lý tài khoản người dùng. Mỗi thành viên chỉ được phép đăng ký, sử dụng một account duy nhất trên website. Như vậy giúp bảo mật thông tin đồng thời tạo điều kiện thuận lợi để nền tảng cung cấp các dịch vụ, ưu đãi phù hợp cho từng thành viên. Quy định này đảm bảo bạn sẽ luôn nhận được sự chăm sóc, hỗ trợ tốt nhất.

Website có an toàn không?

Tại MMLive, vấn đề bảo mật thông tin là một trong những ưu tiên hàng đầu. Nền tảng hiện đang áp dụng các công nghệ hiện đại nhất để giúp dữ liệu cá nhân của hội viên luôn an toàn tuyệt đối.

Mọi thông tin anh em cung cấp sẽ được mã hóa, xử lý một cách an toàn tuyệt đối. Bạn có thể hoàn toàn yên tâm khi tham gia vào cộng đồng vì nền tảng cam kết mang đến môi trường giải trí trực tuyến an toàn, đáng tin cậy, tận hưởng mọi trải nghiệm mà không lo ngại về vấn đề bảo mật.

MMLive luôn mang đến anh em những giây phút thư giãn qua các trò chơi và hoạt động giải trí đồng thời tạo ra không gian giao lưu đầy thú vị giữa các hội viên. Anh em đang tìm kiếm phút giây thư giãn tuyệt vời, kết nối cùng gái xinh lại có thể tham gia những trò chơi đổi thưởng hấp dẫn thì không thể bỏ qua MMLive, một lựa chọn tuyệt vời.