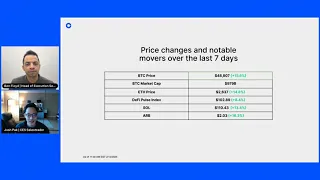

The US Securities and Exchange Commission (SEC) has delayed its decision on seven spot Bitcoin ETF applications from BlackRock, Bitwise, VanEck, Fidelity, Valkyrie, Invesco Galaxy, and WisdomTree. The decision was expected on September 28, 2023, but the SEC has pushed it back to October 13, 2023.

This delay is a setback for the crypto industry, which has been eagerly awaiting the approval of a spot Bitcoin ETF. A spot Bitcoin ETF would allow investors to invest in Bitcoin without having to buy the cryptocurrency directly. This would make it easier for investors to gain exposure to Bitcoin and could lead to increased adoption of the cryptocurrency.

The SEC has not given a reason for the delay, but it is likely that the agency is still concerned about the risks associated with Bitcoin ETFs. The SEC has previously rejected multiple spot Bitcoin ETF applications, citing concerns about market manipulation and fraud.

The delay is also likely due to the SEC’s current focus on crypto regulation. The SEC has been cracking down on crypto companies in recent months, and it is possible that the agency is taking more time to review the spot Bitcoin ETF applications to ensure that they meet all of the regulatory requirements.

Analysis:

The delay in the approval of spot Bitcoin ETFs is a significant development for the crypto industry. It is a sign that the SEC is still hesitant to approve Bitcoin ETFs and that there are still regulatory hurdles that need to be overcome before spot Bitcoin ETFs can be launched.

The delay is also a reminder that the crypto industry is still in its early stages of development. There is a lot of uncertainty about the future of cryptocurrencies, and it is likely that there will be more regulatory hurdles ahead.

However, the delay is not necessarily a bad thing. It gives the SEC more time to review the spot Bitcoin ETF applications and to ensure that they meet all of the regulatory requirements. This could lead to the launch of more robust and compliant Bitcoin ETFs in the future.

Discussion about this post