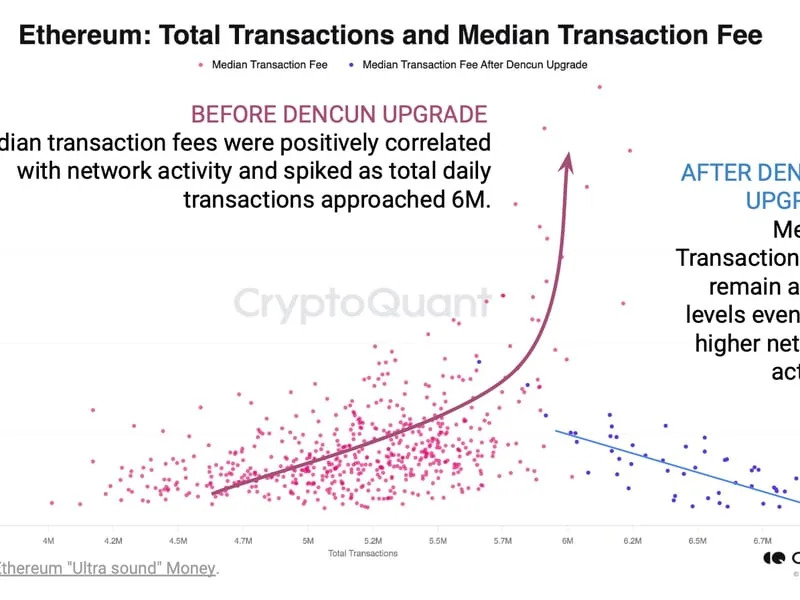

Ethereum hodlers, brace yourselves! The highly anticipated Dencun upgrade, designed to slash transaction fees and boost scalability, might have come at a cost. New data suggests Ethereum (ETH) is back in inflationary territory, potentially negating a core benefit of the 2022 Merge.

Dencun: A Double-Edged Sword?

A report by CryptoQuant reveals a double-edged sword situation with Dencun:

-

Mission Accomplished: Lower Fees – Dencun successfully delivered on its promise of significantly reduced transaction fees. On average, fees are now a quarter of what they were pre-Dencun.

-

The Burn Rate Dilemma: The reduced fees, however, come at a cost. The amount of ETH burned has plummeted to near post-Merge lows. This is because Dencun separates transaction fees from block rewards, meaning fewer fees are burned.

A Reversal of Fortune: Supply and Demand

The Merge, with its burning mechanism, successfully transitioned Ethereum to a deflationary asset. Since September 2022, the total ETH supply had shrunk from 120.491 million to 120.097 million. However, Dencun disrupted this trend. With fewer fees being burned, the natural increase in ETH supply is now outpacing the amount removed. This has resulted in a net supply increase of approximately 400,000 ETH tokens since April.

The Ethereum Endgame: Deflation Still Possible?

While the current situation raises concerns, it’s important to consider the bigger picture. The Ethereum development team is still working on further scaling solutions, which could once again tip the balance towards deflation.

The Bottom Line: A Cause for Concern, But Not Panic

The return of Ethereum inflation is a development to watch closely. While it chips away at the deflationary narrative, it doesn’t necessarily negate the long-term potential of Ethereum. The success of future scaling solutions will be crucial in determining whether Ethereum can maintain its deflationary edge.

Discussion about this post