Bitcoin, the decentralized digital peer-to-peer payment network, has become the talk of the town due to its increasing value in recent years. Like the Gold Rush of the 19th century, the value of Bitcoin has skyrocketed, attracting investors from all over the world. In January 2020, Bitcoin was worth around $7,200, but it has since risen by an astounding 844%, reaching an all-time high of $68,000 in November 2021, thanks to factors such as institutional investors’ interest.

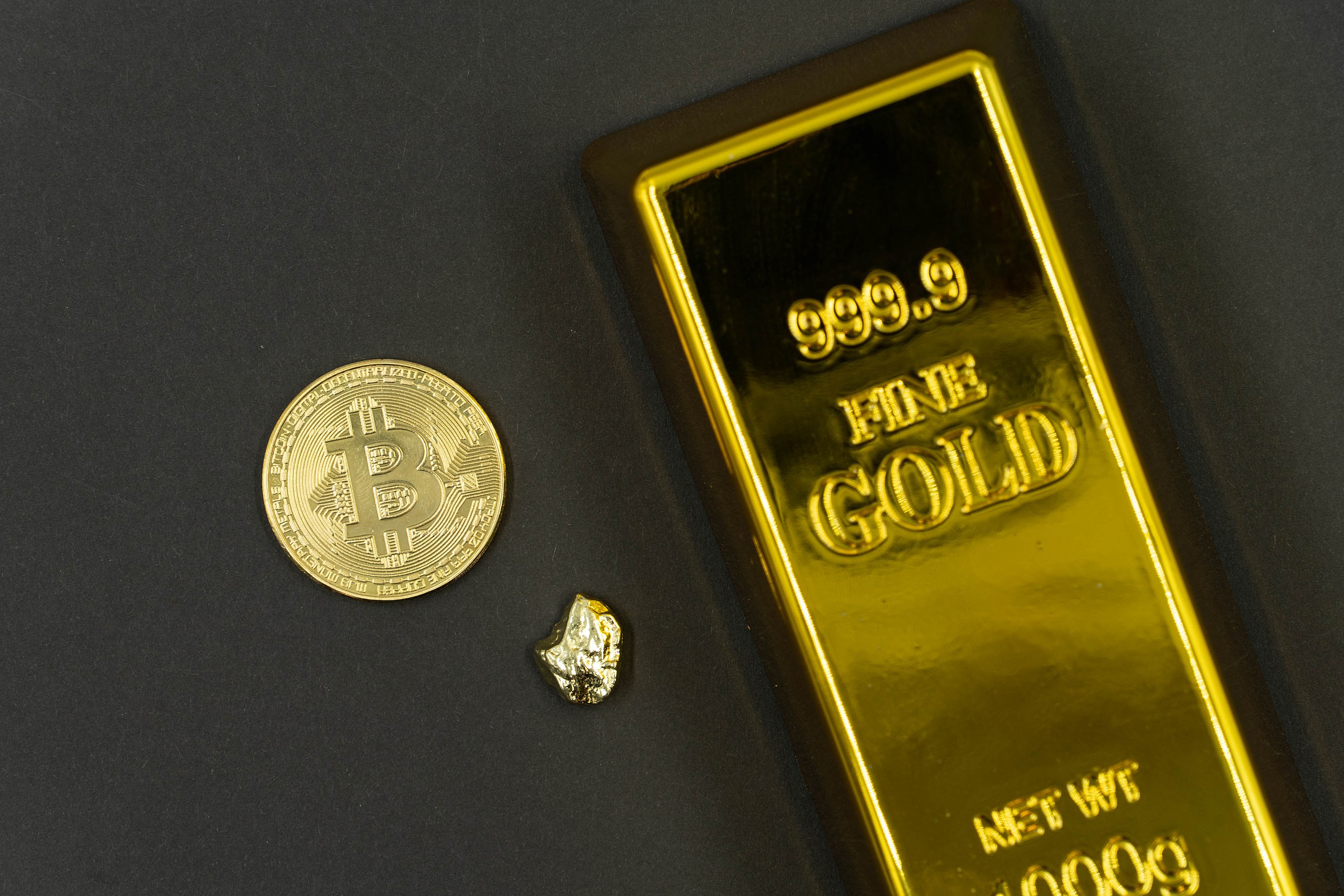

The value of Bitcoin can be compared to the value of gold. The scarcity of gold due to limited supply has increased its demand and, therefore, its value. Similarly, the supply of Bitcoin is limited to 21 million, and investors fear missing out on acquiring it before the last millions are mined. Furthermore, Bitcoin’s decentralized nature means that control is not centralized and every user on the platform can participate in decision-making, making it extremely difficult to manipulate the system.

Bitcoin’s value is also derived from the success of projects that have incorporated its technology and the solutions that these projects have implemented in the ecosystem. The blockchain system that Bitcoin implemented has revolutionized the way companies function, maintaining openness about tasks and decisions while making data openly available to users.

During the pandemic, the government policies fueled investors’ fears about the global economy, causing a surge in Bitcoin activity. Investors and large corporations have sought alternative forms to store their assets, leading to the rise of Bitcoin’s value. Like gold, Bitcoin cannot be formed at random but needs to be mined first. The legitimacy of Bitcoin as a form of currency is demonstrated by the value of the mining process.

Bitcoin’s value has had its lows, such as trading at less than $30,000 in July 2021. However, it has strengthened its position and is currently valued at over $43,000. The increasing value of Bitcoin has become a modern-day Gold Rush, attracting investors seeking to store their wealth in a decentralized and transparent currency.

Discussion about this post